The holiday season is often a time filled with joy, celebration, and family gatherings. However, for starting families, or those with your kids, it can also be a time of financial stress. Creating a holiday budget is crucial to ensure that you can enjoy the festivities without overextending your finances.

In this blog, we will explore ways to craft a holiday budget for starting families, incorporating key elements like money management, planning, and setting financial goals. Read on!

Understanding the Importance of a Holiday Budget

For many families, the holiday season often leads to increased spending. From things like gifts and decorations to travel and food, the expenses can quickly add up. By instituting a holiday budget for starting families, you can take control of your money, ensuring that you maintain financial stability while still enjoying the season’s content.

Why Budgeting Matters

Budgeting helps you understand where your money goes, allowing you to account for all potential expenses. This financial planning can prevent unnecessary debt and make the holidays more enjoyable, knowing you are financially secure.

The Role of Goals

Establishing clear goals is an essential part of budgeting. Determine what is most important for your family during the holidays, whether it’s a special gift for the kids, a family trip, or a festive meal. With these goals in mind, you can allocate your resources effectively.

How to Create a Holiday Budget

Creating a holiday budget doesn’t have to be complicated. Here are some practical steps to help you get started:

Assess Your Financial Situation

Begin by taking a close look at your current financial standing. Consider your income, monthly expenses, and any existing debts. This will give you a clear picture of how much you can afford to spend during the holidays.

Set a Spending Limit

Once you have a clear understanding of your finances, set a realistic spending limit for the holiday season. This limit should be based on your financial goals and the amount you can comfortably afford without compromising your regular expenses.

List Holiday Expenses

Create a list of all potential holiday expenses. This list might include gifts, decorations, travel, food, and entertainment. Having a comprehensive list will help you allocate your budget effectively.

Prioritize Your Spending

Not all holiday expenses are equally important. Decide which items on your list are priorities based on your family’s goals. For example, if creating lasting memories with your kids is a priority, you might allocate more funds to family experiences rather than physical gifts.

Use Cash or Debit Cards

To avoid overspending, consider using cash or your debit card instead of credit cards. This habit can help you stay within your budget, as it limits you to spending only what you have.

Tools and Apps for Efficient Budgeting

In today’s digital age, there are numerous tools and apps designed to make budgeting easier. Here are a few that can help you manage your holiday finances effectively:

Budgeting Apps

There are several apps available that cater specifically to budgeting needs. One popular app is Mint, which allows you to track expenses, set goals, and monitor your financial habits.

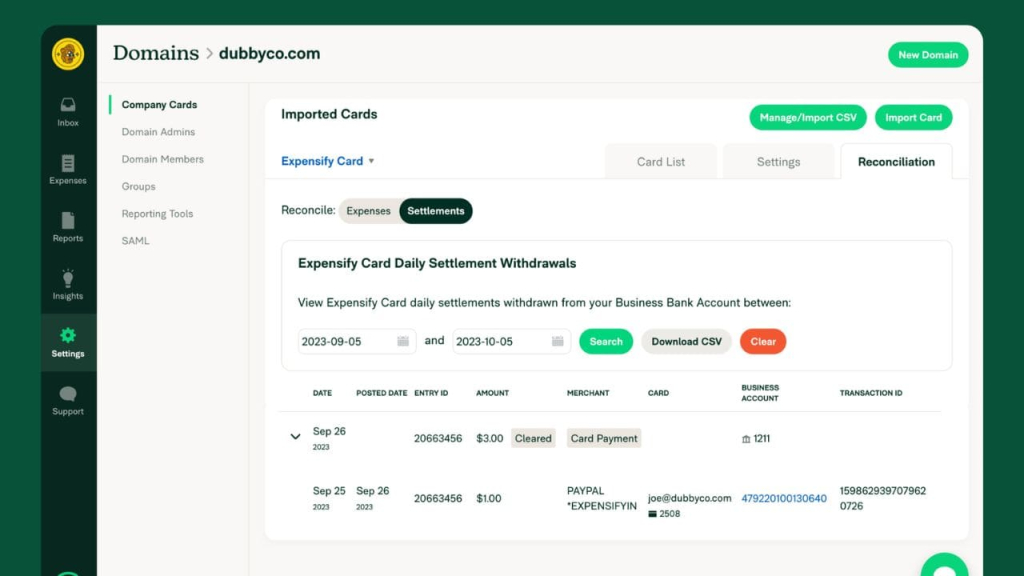

Expense Trackers

Expense trackers like Expensify or Goodbudget enable you to keep a detailed account of your spending. These tools can help you identify spending patterns and adjust your budget as needed.

Financial Planning Tools

For a comprehensive approach to budgeting, consider using financial planning tools that offer a holistic view of your finances. These can help you set long-term goals and plan accordingly.

Developing Healthy Spending Habits

Creating a holiday budget is just the beginning. To ensure financial success, it’s important to cultivate healthy spending habits that will benefit your family in the long run.

Be Mindful of Impulse Purchases

The holiday season often brings enticing sales and promotions. While it can be tempting to make impulsive purchases, sticking to your budget and goals is crucial. Always ask yourself if the purchase aligns with your financial plan.

Involve the Family

Involving the entire family in the budgeting process can be both educational and empowering. Discuss financial goals and priorities with your kids, teaching them the importance of money management from an early age.

Celebrate Creatively

Holidays are not just about spending money; they’re about creating memories. Look for creative ways to celebrate without breaking the bank. For example, organize a family game night or a homemade gift exchange.

Creating a holiday budget for starting families is an essential step to ensure a joyous and stress-free holiday season. By understanding your financial goals, using effective planning strategies, and cultivating healthy spending habits, you can enjoy the holidays without financial worry. Remember, the key is to focus on what truly matters—spending quality time with your loved ones and creating cherished memories that will last a lifetime.